Accident, Critical Illness and Hospital Indemnity Insurance

Winnebago Tribe of Nebraska

provides you the option to purchase accident insurance, critical illness and hospital indemnity insurance through Lincoln Financial. The amount you pay for these plans is deducted from your paycheck on post-tax basis. This ensures that any benefit payments you receive are not taxed. Learn more about the accident and critical illness plans at www.lincolnfinancial.com

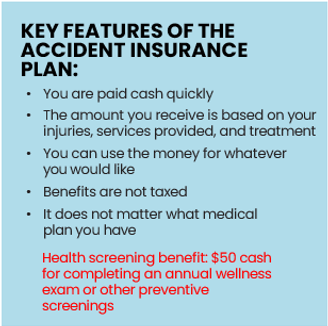

Accident insurance is a policy that can help you pay expenses that may follow an accident, including out-of-pocket health care costs. This plan pays benefits if you are injured in an accident, regardless of whether or not you are at work.

Critical illness insurance is a policy that provides a lump-sum, cash benefit if you are diagnosed with a covered illness (e.g., heart attack, stroke, cancer). These diagnoses can cause significant financial burden, especially if you are unable to work while receiving treatment. You can use the money you receive however you would like, including to help you pay your mortgage, pay your deductible, seek experimental treatment, or for any other expenses. The benefit amount you receive is based on the level of coverage you purchase. You may also purchase coverage for your spouse and/or dependent children.

Coverage Options:

-

Employee: $10,000, $20,000 or $30,000; Guarantee Issue: You can choose from the coverage amount(s) above.

-

Spouse: $5,000, $10,000 or $15,000 (up to 50% of the employee coverage amount); Guarantee Issue: You can choose from the coverage amount(s) above.

-

Dependent children : Automatically receive 25% of your coverage amount at no extra cost