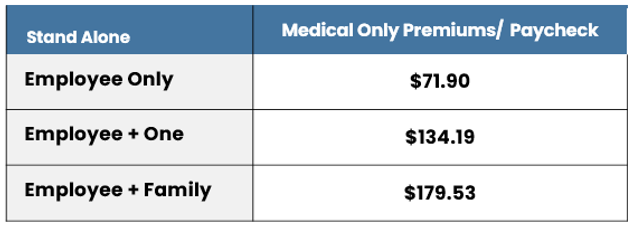

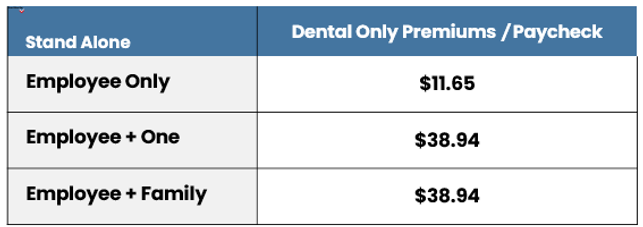

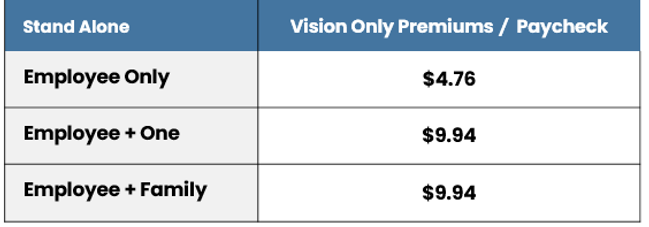

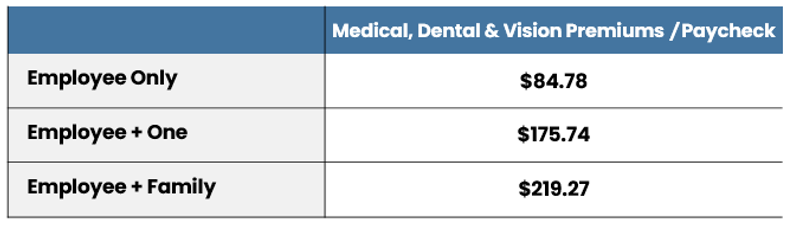

Employee Contributions

Winnebago Tribe of Nebraska

will contribute a percentage of the monthly employee and dependent premiums for the medical. To view per period rates please log onto Employee Navigator to review the medical plan cost as well as the dental and vision cost.

Premiums are deducted from your paycheck on a before tax basis.

Please refer to Employee Navigator for details specific to your coverage.

Deductions will be taken from your paycheck on a before-tax basis, under the IRS Section 125 Premium Only Plan.

For federal tax purposes, a domestic partner is not considered a legal spouse. For this reason, the premium for a domestic partner will be deducted from your paycheck on an after-tax basis. The employer is also obligated to report the premium or fair market value on your W-2 form.