FLEXIBLE SPENDING ACCOUNT & DEPENDENT CHILD CARE FSA

Winnebago Tribe of Nebraska offers flexible spending account (FSA) options through Employee Benefits Corporation(EBC). The money that you put into an FSA is collected from your paycheck before taxes are withheld, which means you don’t pay taxes on those dollars. Basically, it is like using a 25% off coupon for your health care and dependent care expenses! Please read this page carefully before you make your FSA elections.

•Health care FSA dollars can be used to pay for eligible out-of-pocket expenses such as deductibles, copays, and other health-related expenses that are not reimbursed by the medical, dental, or vision plans

•Use dollars to pay for over-the-counter

(OTC) medications

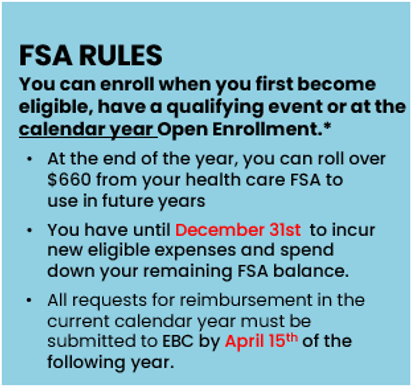

*PLEASE NOTE: All eligible Employees will receive a separate Employee Navigator Open Enrollment notice in Oct/Nov to advise of new IRS contribution amounts and to enroll/update Elections for a 1/1/2026 effective date.

•For the 2025 calendar year, you may contribute up to $3,300 to your health care FSA. The entire amount you elect is available to you on January 1 or on your benefits effective date.

•At the end of the 2025 year, if you have unused FSA funds you can roll over $660 from your health care FSA to use in the future 2026 plan year. However, you must elect coverage at the next FSA Open Enrollment available Nov/Dec in order transfer unused funds.